How Our Investment

Model Works

We partner with investors committed to advancing national development through carefully structured, low-risk programs.

These initiatives uphold strong governance standards, benefiting both public institutions and generating sustainable long-term returns. Our funding models prioritize transparency, accountability, and enduring impact.

Eligibility & Due Diligence

Established specifically to serve this mandate, ISCM Investments raises funds exclusively for projects owned,

developed, and approved by the ISCM Foundation, ensuring all capital is governed with strict oversight and integrity. As

a prerequisite for any investor participation, only projects formally under the ISCM Foundation are eligible; therefore, the

intake process is reserved solely for project owners or investors seeking to have their projects formally adopted by the ISCM Foundation.

Intake Process – Assignment of project exclusively to the ISCM Foundation

1. Meetings

(Introduction)

2. Application

(Support Request & NCNDA)

3.* Project Commitment by Government or Business (IASA)

Securities Commitment by ISCM Foundation (MoA)

(Investor Confidence Report & Memorandum of Agreement)

On-Boarding Process – Allocated funding and guarantees to the project

4.* Project Funds

(Fundraising with Banks)

5.* Supervision with bank partners

(Funding Governance)

6.* Local Implementation Office

(Establishment of the local CBE)

7.* Project Companies

(Special Purpose Vehicles)

Integrity Platform (External Controls)

Audit | Legal | Compliance | Bank | Trust Accounts

* Step passes through the Integrity Platform

(This indicates additional checks, logging, or validation via the Integrity Platform.)

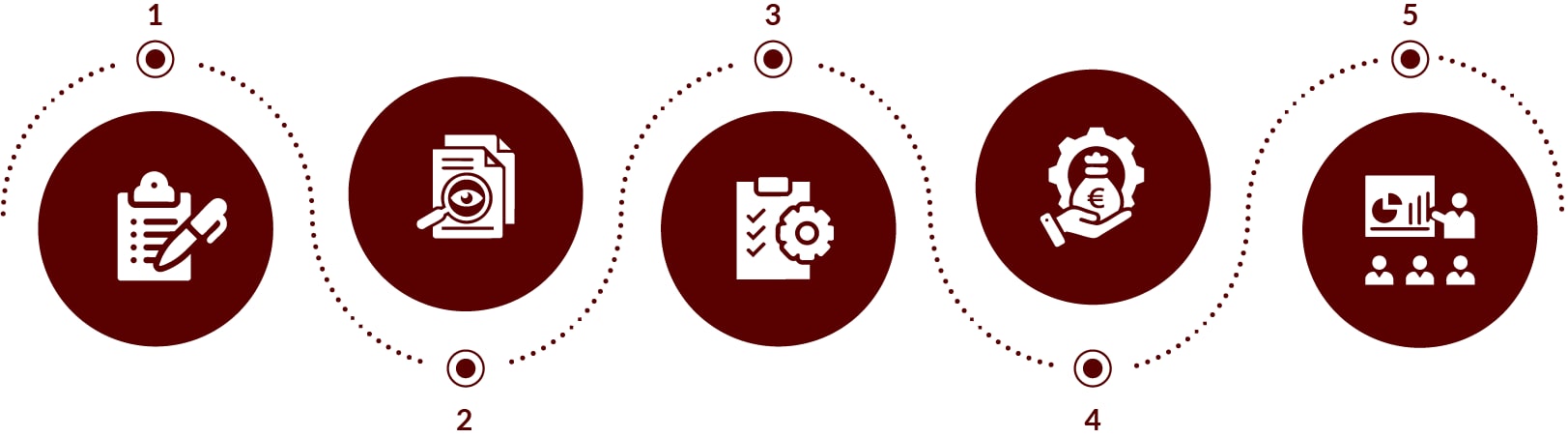

Investor Onboarding Process

Investor participation is structured through a regulated private equity fund domiciled in Luxembourg.

This governance mechanism introduces a sovereign layer of trust, transparency, and regulatory oversight—ensuring that private capital is channeled responsibly and solely towards long-term national development objectives.

If you represent a qualified institutional investor, government body, or board-level project owner, you may begin the onboarding process below.

Initiate Contact

Eligibility begins with a formal inquiry submitted by a board member or senior executive.

Integrity Review

Applicants undergo comprehensive due diligence via our Integrity Platform, including full KYC and AML verification procedures.

Project Briefings & Fund Participation

Qualified investors gain exclusive access to briefings on vetted investment opportunities and may participate in the Luxembourg-based private equity fund.

Preliminary Compliance Screening

All applicants are subject to initial fraud examination protocols and regulatory compliance assessments prior to any engagement with ISCM’s partner banks.

Capital Qualification

Submission and validation of capability to provide Standby Letters of Credit (SBLC) or cash-backed securities to meet capital requirement thresholds.

Investor Onboarding Process

Investor participation is structured through a regulated private equity fund domiciled in Luxembourg.

This governance mechanism introduces a sovereign layer of trust, transparency, and regulatory oversight—ensuring that private capital is channeled responsibly and solely towards long-term national development objectives.

If you represent a qualified institutional investor, government body, or board-level project owner, you may begin the onboarding process below.

1. Initiate Contact

Eligibility begins with a formal inquiry submitted by a board member or senior executive.

2. Preliminary Compliance Screening

All applicants are subject to initial fraud examination protocols and regulatory compliance assessments prior to any engagement with ISCM’s partner banks.

3. Integrity Review

Applicants undergo comprehensive due diligence via our Integrity Platform, including full KYC and AML verification procedures.

4. Capital Qualification

Submission and validation of capability to provide Standby Letters of Credit (SBLC) or cash-backed securities to meet capital requirement thresholds.

5. Project Briefings & Fund Participation

Qualified investors gain exclusive access to briefings on vetted investment opportunities and may participate in the Luxembourg-based private equity fund.

Key Parameters

Mode of Investment:

Via cash, SBLC or cash-backed securities

Project Lifecycle:

5 – 25 years

De-Risked Capital Protection:

Via 100% cash-backed securities as collateral

Investor Returns and Exit Strategy:

Clear exit timelines and structures help manage investor expectations

Risk and Legal Framework

Structured to operate under the Integrity Platform, an independent regulatory body, comprising of banking partners and professional compliance, trust audit and legal firms.

They are tasked with executing all financial aspects of contractual and funding arrangements.